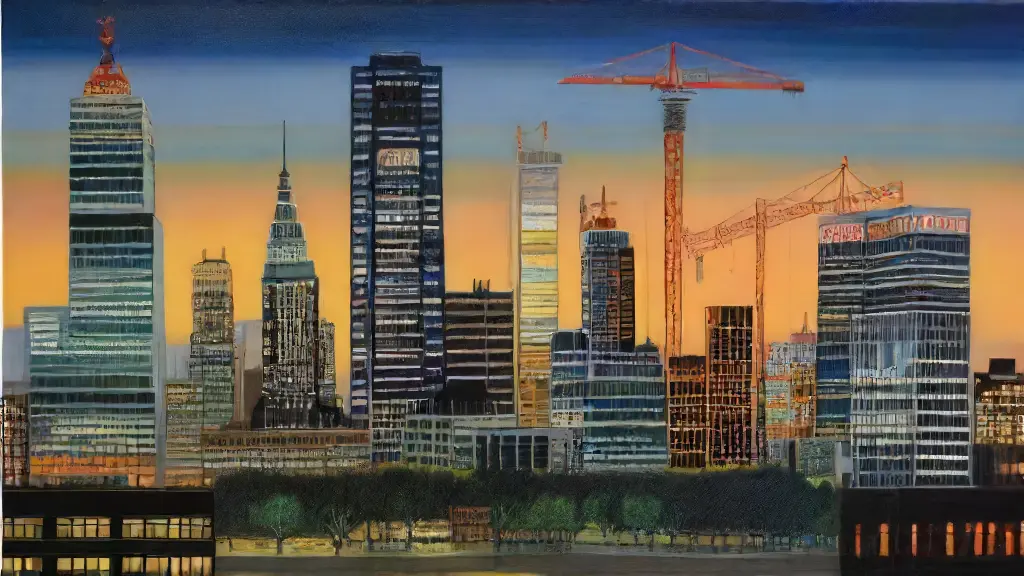

Real Estate Cycle Phases

Navigating the property market trends to achieve a successful sale can be a daunting task, especially with market downturns and upswings occurring frequently.

Understanding these phases is crucial for sellers to price their properties correctly and market them effectively, ultimately influencing the time it takes to sell.

During a market upswing, characterized by increasing sales and prices, buyers become more confident, and sellers often set higher price expectations.

This optimism can lead to a boom phase, where prices surge, and the market becomes overheated, often followed by a sharp decline in prices.

Real estate market trends are cyclical, with periods of contraction and expansion resulting in varying market conditions for sellers. The market contraction, often marked by reduced sales and decreased prices, provides an opportunity for investors to buy properties at lower costs.

Expansion

The real estate market exhibits complex and cyclical patterns, shaped by various factors affecting supply and demand.

A buyer’s market occurs when there is an overabundance of homes available, forcing prices to drop, which in turn favors sellers but often causes them to struggle to reach their asking price.

This creates a market equilibrium where buyers and sellers converge, often resulting from a market experiencing an expansion phase, characterized by the addition of new developments and increasing property valuations.

Property investors focus on identifying these market trends to maximize their profits, carefully monitoring supply and demand dynamics to inform their decisions.

During this phase, developers often experience a decline in opportunities due to the drop in property valuations, making it essential for them to adjust their strategies to stay competitive. A thorough real estate market analysis is crucial in making informed decisions, taking into account economic indicators and government reports that provide valuable insights into the overall condition of the buyers market, sellers market, market equilibrium, economic indicators, housing market analysis, property valuations, market forecasting, real estate investing, and property development.

Market Volatility

The dynamic interplay between economic growth and housing affordability plays a pivotal role in shaping the dynamics of the construction industry. Driven by economic fluctuations, construction projects can either thrive or decline rapidly, making it essential for buyers and investors to navigate these changes effectively.

Interest rates, directly tied to inflation and employment rates, are critical factors that influence the market; while periods of low unemployment can actually lead to increased inflation, seen in rising housing costs.

Managing these changes is the key to long-term investments, equipping buyers and investors with the knowledge to navigate fluctuations in the construction industry and the primary indicator interest rates can help avoid economic pitfalls.

Real estate market values are greatly influenced by housing affordability and the many factors that impact property prices, such as mortgage rates, wage growth, and demographic shifts, which can have a ripple effect on the industry as a whole. When housing affordability is tied to the construction industry, economic growth, recession, inflation, deflation, interest rates, mortgage rates, housing affordability, property prices, it is greatly affected by changes in all of these factors.

Key Factors Influencing the Construction Industry

- Interest rates are directly tied to inflation and employment rates, significantly impacting the market.

- Low unemployment can lead to increased inflation, resulting in rising housing costs.

- Mortgage rates, wage growth, and demographic shifts are key factors influencing real estate market values and property prices.

- Housing affordability is greatly affected by changes in economic growth, recession, inflation, and interest rates.

What Triggers Downturn

Market fluctuations are often the result of a complex interplay between economic and demographic forces that can quickly spiral out of control.

Understand the key drivers of the housing market’s sensitivity to interest rates and inflation, as even minor adjustments can significantly impact demand and supply.

Conducting a demographic analysis can provide valuable insights into shifts in housing demand, such as the trend of younger generations opting for rentals over homeownership and the subsequent effects on the local market.

A closer examination of market dynamics reveals that speculation and flipping can lead to overinvestment and market saturation, causing prices to skyrocket and leaving many individuals unable to afford homes.

This phenomenon occurs when investors prioritize quick resale over long-term stability, creating a volatile market environment that fosters unsustainable trends. Market imbalances and unsustainable trends can create a toxic environment for the housing market, making it crucial for participants to be aware of the risks associated with market volatility, economic uncertainty, business cycles, demographic analysis, geographic analysis, market trends, market analysis, property appraisal, and market evaluation.

Economic Indicators Matter

How Economic Data Drives Real Estate Success In the ever-changing landscape of real estate, a keen understanding of economic data is the key to unlocking lucrative opportunities and avoiding costly pitfalls. By tuning into the right economic indicators, savvy investors can make informed decisions that drive their success and outperform the market.

I.

Introduction

Economic indicators are a crucial component of any successful real estate investment strategy, providing valuable insights into market trends and economic conditions.

A comprehensive understanding of these indicators is essential for navigating the complexities of the real estate market and achieving long-term success.

II.

Understanding Economic Indicators

Economic indicators are statistical measures that provide a snapshot of an economy’s health and performance. GDP (Gross Domestic Product): A measure of a country’s economic output, representing the total value of all final goods and services produced within its borders.

Economic Indicators for Real Estate Success

- GDP (Gross Domestic Product) is a key indicator of a country’s economic health, with a growth rate of 2-3% considered healthy.

- The unemployment rate is another crucial indicator, with a rate below 5% generally indicating a strong labor market.

- The Consumer Price Index (CPI) measures inflation, with a rate of 2-3% considered moderate and manageable.

- The interest rate, set by the central bank, affects borrowing costs and can impact real estate investment decisions.

How to Time Market Entry

The key to unlocking successful real estate investing is to navigate the complex world skillfully and thoughtfully, building a strong foundation through continued education and hands-on experience. Accurate and timely market information is crucial to making informed decisions, and statistically analyzed market data can help investors identify potential opportunities and pitfalls.

Many investors struggle to find the right entry point, as market trends and fluctuations can make timing a crucial component of achieving investment goals.

Understanding the Real Estate Market Cycle

The real estate market is a dynamic and ever-changing entity, subject to its own unique cycles that can significantly impact investment decisions.

At its core, the market cycle comprises four distinct phases: accumulation, markup, distribution, and stagnation. Each phase presents its own set of challenges and opportunities that investors must navigate to maximize returns. By mastering the art of timing market entry based on property management, real estate agents, market data, market information, economic data, statistical analysis, market research reports, property market reports, and real estate market news, investors can gain a competitive edge in the ever-changing real estate landscape.

Understanding Market Equilibrium

In today’s fast-paced property market intelligence, achieving a balance between supply and demand is crucial for a stable real estate market. This balance is often referred to as market equilibrium, where the price and quantity of properties traded are at equilibrium.

Market equilibrium occurs when the aggregate demand for properties equals the aggregate supply of properties.

This balance is achieved when the price of properties is such that the quantity of properties demanded by buyers equals the quantity of properties supplied by sellers, according to a thorough real estate market analysis.

The supply of properties refers to the total number of properties available for sale, while the demand for properties refers to the total number of properties that buyers are willing and able to purchase, as revealed by property market research. When the supply of properties exceeds demand, prices tend to fall, and when demand exceeds supply, prices tend to rise, as indicated by market studies. Various factors such as property market intelligence, real estate market analysis, property market research, market studies, property surveys, market analysis tools, property software, real estate market data, and market information systems provide insights to industry stakeholders.

Key Points for a Stable Real Estate Market

- Market equilibrium occurs when the aggregate demand for properties equals the aggregate supply of properties.

- The supply of properties refers to the total number of properties available for sale, while demand refers to the total number of properties that buyers are willing and able to purchase.

- When the supply of properties exceeds demand, prices tend to fall, and when demand exceeds supply, prices tend to rise.

- Factors such as property market intelligence, real estate market analysis, and market studies provide insights to industry stakeholders.

Real Estate Investing Strategies

Bright investors strategically position themselves by combining market timing with effective property market evaluation techniques, which significantly increases their chances of achieving long-term success in the real estate industry.

Regular market trends analysis is essential for making informed decisions in real estate investing.

A typical market cycle consists of four stages: expansion, contraction, stagnation, and recession.

To navigate these stages effectively, identify the key characteristics of each, such as rising prices during expansion and falling prices during contraction.

Real estate market segmentation analysis is crucial in understanding these differences, enabling investors to make strategic decisions.

For an informed investment, market segmentation analysis should be performed by recognizing the characteristics of each stage.

- Interest rate changes: rising rates typically signal a market correction, while falling rates indicate a potential shift towards a bull market phase, which is characterized by increasing demand and property prices in business cycle analysis, market segmentation analysis, market trends analysis, property market evaluation, real estate investment analysis, property development analysis, construction project analysis, property renovation analysis, market timing analysis.

.

What is Market Contraction

The subtle yet significant shift in market dynamics, often marked by a decline in economic activity, can be a precursor to a prolonged period of market contraction. This phenomenon is not unique to any particular industry, but its impact can be particularly felt in sectors such as real estate, where market fluctuations can have a ripple effect on property values and investor confidence.

A thorough market participation analysis can provide valuable insights into the market’s progression, helping to identify the ideal phase of the cycle and anticipate potential fluctuations.

By examining various stages of the market cycle, including the upward trend, peaking, and decline, investors and property owners can make informed decisions about market entry, exit, or participation.

Understanding the nuances of market participation analysis can help navigate the challenges of market contraction, ensuring that investment strategies are aligned with the market’s current phase. The downturn, signaled by decreased economic activity, unstable prices, and a decline in market data analysis.

| Header 1 | Header 2 |

|---|---|

| Economic Activity Index | Unstable Prices |

| Market Cycle Length | Investor Confidence Index |

| Market Fluctuation Impact | Property Value Decline Rate |

Seasonal Trends and Their Impact on Sales

How Interest Rates Affect Home Sales

Seasonal Trends and Their Impact on Sales

How Interest Rates Affect Home Sales